MFin: Everything You Need to Know

If you are passionate about finance and looking to accelerate your career in investment banking, asset management, private equity, fintech, or corporate finance, a Masters in Finance (MFin) might be more suitable for you than an MBA. But what exactly is an MFin? Who is it for? And how does it compare to an MBA or other graduate finance degrees?

In this post, I am going to give you a detailed breakdown of the MFin program – what is it and who is it meant for, admissions criteria, top programs, post-graduation outcomes, and whether it’s the right choice for you.

What is an MFin?

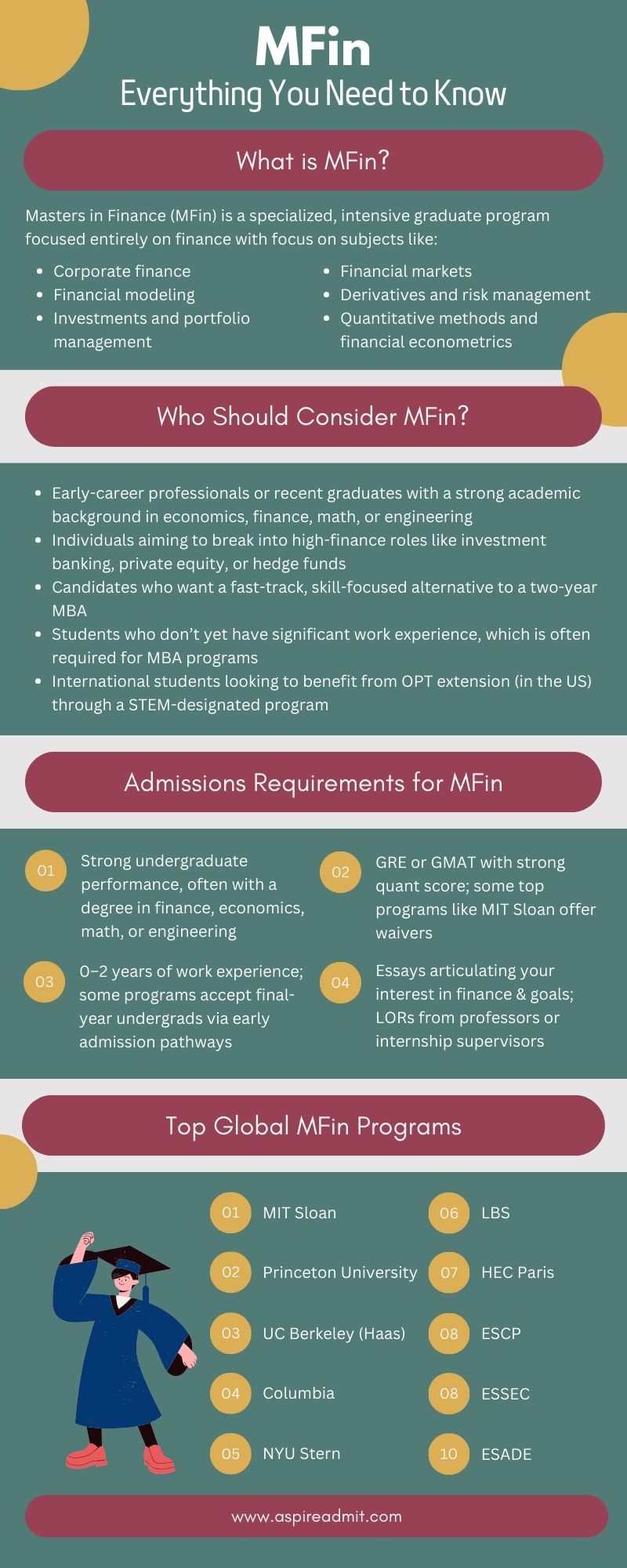

The Masters in Finance (MFin) is a specialized, intensive graduate program focused entirely on finance. Unlike an MBA, which covers a broad range of business topics, the MFin focused more into core areas of finance like:

- Corporate finance

- Financial modeling

- Investments and portfolio management

- Financial markets

- Derivatives and risk management

- Quantitative methods and financial econometrics

Many MFin programs in the USA are STEM-designated, meaning they emphasize analytical and technical skills – ideal for those targeting roles that require strong quantitative foundations.

Who Should Consider an MFin?

MFin programs are typically geared toward:

- Early-career professionals or recent graduates with a strong academic background in economics, finance, math, or engineering.

- Individuals aiming to break into high-finance roles like investment banking, private equity, or hedge funds.

- Candidates who want a fast-track, skill-focused alternative to a two-year MBA.

It’s also a great fit for:

- Students who don’t yet have significant work experience, which is often required for MBA programs.

- International students looking to benefit from OPT extension (in the US) through a STEM-designated program.

How Long is the MFin?

Program lengths vary, but most MFin degrees are:

- 10 to 18 months long

- Offered in full-time formats, with a few part-time or online options available

- Sometimes offered in multiple tracks (e.g., 12-month vs. 18-month options depending on prior experience or internship availability)

How Much Does It Cost?

The cost of an MFin program can vary significantly depending on the school and location. On average:

- Top US programs (e.g., MIT Sloan, Princeton, Columbia) cost $70,000 to $90,000+ in tuition alone

- European programs like LBS, HEC Paris, or ESCP typically range from €35,000 to €55,000

- Asian schools like NUS or HKUST often fall in the $30,000 to $50,000 range

Keep in mind:

- These figures usually exclude living expenses, which can add $15,000–$30,000 depending on the city

- Scholarships and assistantships are available at many schools, although competition is intense

- MFin programs generally offer a strong ROI, with many graduates landing high-paying roles soon after graduation

Want to know if MFin is right for you?

Admissions Requirements

While criteria vary based on each school, top MFin programs generally look for:

1. Academic Background

A strong undergraduate performance, often with a degree in finance, economics, math, engineering, or related fields. Strong quant performance is key.

2. Test Scores

- GRE or GMAT – many programs accept both, though quant scores carry more weight.

- Some top programs (e.g., MIT Sloan) have waived the test requirement recently, but it would be a good idea to submit scores to make your application competitive.

3. Experience

- 0–2 years of work experience is typical.

- Some programs (like Princeton or MIT Sloan) may admit exceptional final-year undergrads via early admission pathways.

4. Essays and Recommendations

- Strong essays articulating your interest in finance, short-term goals, and why the specific program is right for you.

- Letters of recommendation, from professors or internship supervisors if you have little to no work experience.

5. Quantitative Aptitude

If your undergrad GPA or coursework does not show sufficient quant skills, some programs may require additional proof – like passing CFA Level I or taking online courses in stats/calculus.

Get your profile evaluated

Top MFin Programs

Here are some of the most highly regarded MFin programs in the world:

United States

- MIT Sloan – Perhaps the gold standard, known for its quant rigor and connections to Wall Street

- Princeton University – Extremely selective, with a strong theoretical focus

- UC Berkeley (Haas) – STEM-designated Master of Financial Engineering Program with great placement in tech and finance

- Columbia – Offers Master of Science in Financial Economics which is STEM eligible

- NYU Stern – Offers Master of Science in Global Finance (MSGF) Program in collaboration with the HKUST Business School

Europe

- London Business School (LBS) – Highly regarded in Europe and globally, with flexible electives.

- HEC Paris – Part of the prestigious Parisian Grande École ecosystem.

- ESCP and ESSEC – Excellent ROI and known for placing grads in European finance roles.

- IE Business School and ESADE – Popular among international students looking to break into European banking or fintech.

Asia

- National University of Singapore (NUS) – Excellent placement in Southeast Asia.

- HKUST and CUHK – Strong options for targeting Greater China roles.

Career Outcomes

Graduates of MFin programs typically land roles like:

- Investment Banking Analyst

- Equity Research Associate

- Asset/Wealth Management Analyst

- Private Equity or Venture Capital Analyst

- Risk Analyst or Quant Analyst

- Fintech Product or Strategy roles

- Corporate Finance or Treasury Associate

Many MFin grads end up in bulge-bracket banks (like Goldman Sachs, JP Morgan, Morgan Stanley), Big 4 firms, or elite boutiques. In Europe and Asia, sovereign wealth funds, family offices, and fintech startups also recruit MFin graduates heavily.

MFin vs MBA: What is the Difference?

| Feature | MFin | MBA |

| Focus | Specialized in finance | Broad general management |

| Duration | 10–18 months | 1–2 years |

| Target Profile | Recent grads or early-career | Professionals with 3–5+ years of experience |

| Career Goal | Enter finance roles quickly | Switch industries, functions, or locations |

| Curriculum | Deep quant & finance focus | Broader electives (leadership, ops, marketing) |

If you are an early career professional and want to specialize in finance, the MFin gives you the skills and access you need, is faster and more affordable than an MBA.

But if you are looking for career change, leadership training, or a broader business network, an MBA might be a better long-term fit.

Read this post to know more about the difference between an MBA and an MFin.

Final Thoughts

Before applying for an MFin degree, take time to reflect on your goals:

- Are you certain you want to work in finance in the long term?

- Do you have the quantitative aptitude for an intense program?

- Would an MBA serve you better down the road?

An MFin can be a powerful tool for launching a career in finance — especially if you are driven, quantitative, and ready to deep-dive into the world of capital markets, corporate finance, or fintech. With top-tier programs across the US, Europe, and Asia, and growing demand for analytical finance talent, MFin is fast becoming a leading path into competitive finance careers across the globe.